Some Of Succentrix Business Advisors

Wiki Article

Get This Report about Succentrix Business Advisors

Table of ContentsSuccentrix Business Advisors for DummiesSee This Report about Succentrix Business Advisors9 Simple Techniques For Succentrix Business AdvisorsThe Ultimate Guide To Succentrix Business AdvisorsExcitement About Succentrix Business Advisors

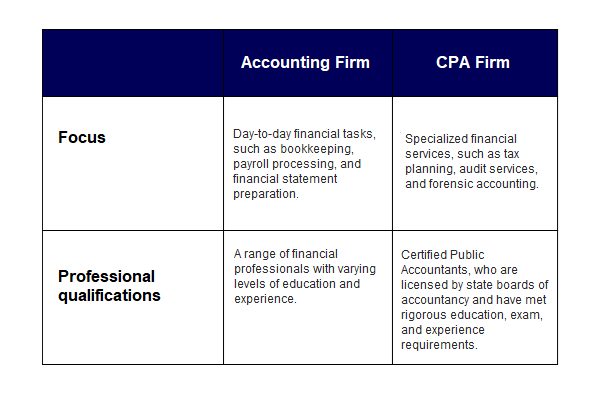

Getty Images/ sturti Outsourcing accounting solutions can liberate your time, protect against errors and also decrease your tax obligation expense. Yet the dizzying selection of services might leave you baffled. Do you need a bookkeeper or a state-licensed accountant (CPA)? Or, probably you want to manage your basic bookkeeping jobs, like accounts receivables, however work with an expert for capital forecasting.Discover the various kinds of bookkeeping solutions readily available and discover how to select the appropriate one for your local business needs. Bookkeeping solutions fall under basic or economic accountancy. General accountancy describes regular responsibilities, such as videotaping deals, whereas financial audit strategies for future development. You can employ a bookkeeper to go into data and run reports or deal with a certified public accountant that supplies financial suggestions.

Prepare and submit tax returns, make quarterly tax obligation settlements, file expansions and take care of IRS audits. Create financial statements, consisting of the equilibrium sheet, profit and loss (P&L), money flow, and earnings statements.

What Does Succentrix Business Advisors Mean?

Track work hours, calculate wages, withhold taxes, issue checks to employees and make sure accuracy. Audit solutions may additionally include making pay-roll tax payments. Additionally, you can hire consultants to make and set up your audit system, give monetary planning recommendations and discuss economic statements. You can contract out chief financial police officer (CFO) services, such as sequence preparation and oversight of mergers and procurements.

Usually, small service proprietors outsource tax obligation solutions first and add payroll support as their company grows., 68% of respondents utilize an outside tax expert or accounting professional to prepare their firm's tax obligations.

Produce a list of procedures and obligations, and highlight those that you want to outsource. Next off, it's time to discover the best audit solution provider (Accounting Franchise). Since you have an idea of what kind of audit solutions you need, the question is, that should you work with to supply them? While an accountant handles information entry, a Certified public accountant can talk on your part to the Internal revenue service and give financial advice.

The 15-Second Trick For Succentrix Business Advisors

Prior to determining, consider these concerns: Do you desire a local accountancy expert, or are you comfortable functioning basically? Does your service need market expertise to do accounting jobs? Should your outsourced solutions integrate with existing bookkeeping tools? Do you intend to outsource human sources (HUMAN RESOURCES) and payroll to the very same vendor? Are you looking for year-round aid or end-of-year tax management services? Can a professional finish the work, or do you require a group of specialists? Do you need a mobile app or on the internet website to manage your accountancy solutions? CO aims to bring you motivation from leading highly regarded specialists.Offered you by Let's Make Tea Breaks Happen! Get a Pure Leaf Tea Break Grant The Pure Leaf Tea Break Grants Program for tiny businesses and 501( c)( 3) nonprofits is currently open! Get an opportunity to money ideas that foster much healthier workplace culture and standards! Ideas can be new or already underway, can originate from human resources, C-level, or the frontline- as long as they boost staff member wellness with society adjustment.

Something went wrong. Wait a moment and attempt once more Try again.

Advisors provide useful insights right into tax obligation techniques, making certain organizations lessen tax obligation obligations while following complicated tax obligation Recommended Reading policies. Tax preparation includes aggressive steps to optimize a firm's tax position, such as reductions, credit scores, and motivations. Keeping up with ever-evolving audit requirements and governing requirements is critical for businesses. Accountancy Advisory professionals aid in financial coverage, making sure exact and compliant financial declarations.

Succentrix Business Advisors Fundamentals Explained

Below's a thorough appearance at these vital abilities: Analytical skills is an important ability of Accounting Advisory Providers. You must excel in celebration and examining monetary data, drawing significant insights, and making data-driven recommendations. These abilities will enable you to assess economic efficiency, identify trends, and deal notified advice to your customers.

Communicating successfully to clients is a vital ability every accountant should possess. You have to be able to share complex monetary information and insights to customers and stakeholders in a clear, understandable fashion. This consists of the capacity to translate monetary jargon into simple language, create comprehensive records, and deliver impactful presentations.

The Definitive Guide for Succentrix Business Advisors

Accounting Advisory firms use modeling methods to replicate different economic situations, assess possible end results, and assistance decision-making. Effectiveness in economic modeling is important for precise forecasting and calculated preparation. As an accountancy advisory firm you must be well-versed in economic laws, accounting standards, and tax laws relevant to your clients' sectors.

Report this wiki page